80% of Dealers Cite Lack of Lender Transparency as #1 Obstacle to Deal and Pricing Clarity

80% of Dealers Cite Lack of Lender Transparency as #1 Obstacle to Deal/Pricing Clarity

Lack of pricing transparency from lenders, complicates dealer efforts to bridge the trust and transparency gap with consumers, according to new eLEND Solutions survey

FOOTHILL RANCH, CA – October 10, 2023 – A new survey of auto dealers from automotive FinTech innovator eLEND Solutions reveals a significant trust and transparency gap between consumers and dealers, partially driven by differences in transaction preferences, but made problematic by a lack of transparency from lenders. Almost universally, dealers see technology as a way to help close the gap and add value to the experience — for customer, dealer and lender.

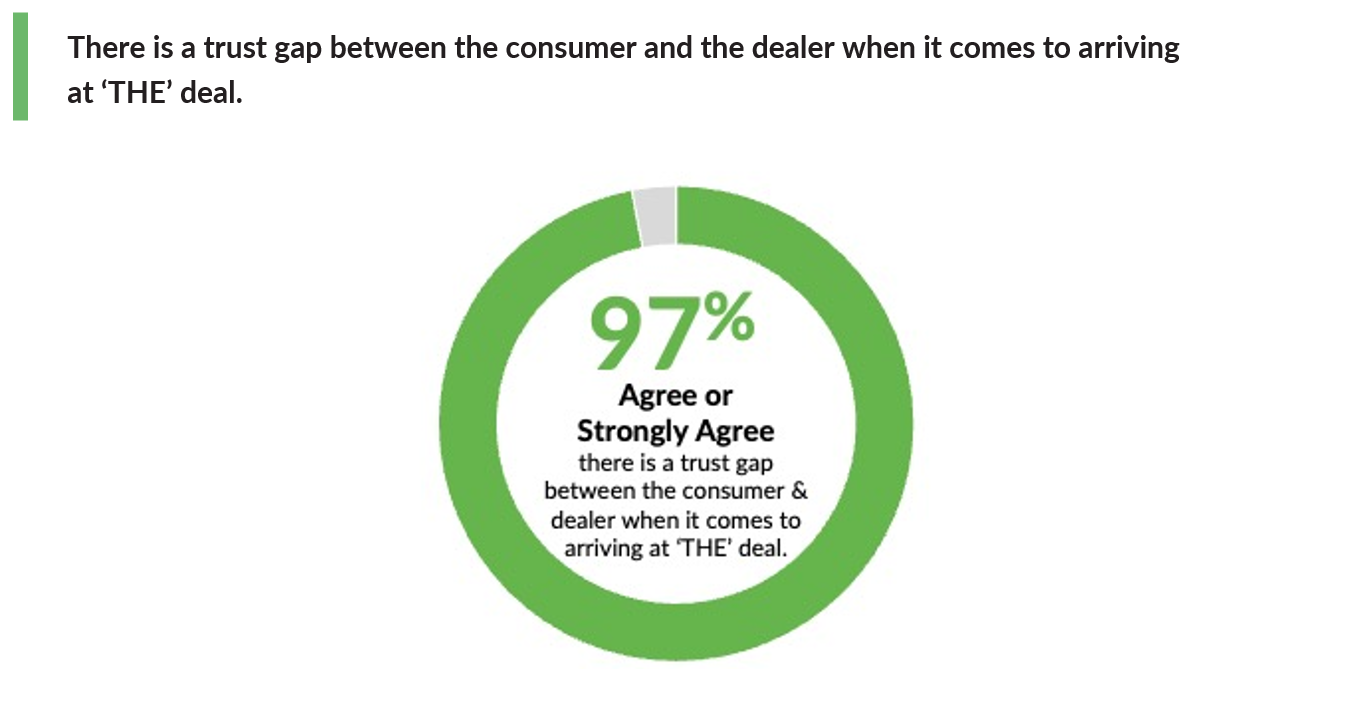

The survey confirms that this trust/transparency gap is a major source of friction in the auto sales transaction process, starting with a disconnect in how it is defined: 94% of auto dealers surveyed said that consumers and dealers define transparency differently, and 82% of dealers strongly agree that this difference has contributed to a trust gap arriving at the “final” deal.

According to the findings, dealers agree there is a trust deficit and understand that consumers want transparency — though many are inhibited from going as far as customers expect them to go, due to concerns about profitability. Still, 95% of dealers find themselves in a difficult balancing act between meeting customer expectations of transparency and protecting the dealership’s bottom line.

“When it comes to transparency and trust, unfortunately, there is friction between dealers and consumers, said Pete MacInnis, eLEND Solutions CEO and Founder. “While this is partly a result of the tug of war between how consumers want to buy and how dealers want to sell, our survey shows that dealers do want to provide transparency to consumers. In fact, most want car buyers to have pricing transparency as early as possible — even before visiting the dealership.”

One of the challenges revealed by the survey is that lenders are adding to the friction of the process, through their lack of transparency when it comes to financing the deal. “Reduced pricing transparency from lenders, thanks to AI and algorithm-based solutions, is pulling a cloak over what’s arguably the most important part of the buying process,” continued MacInnis.

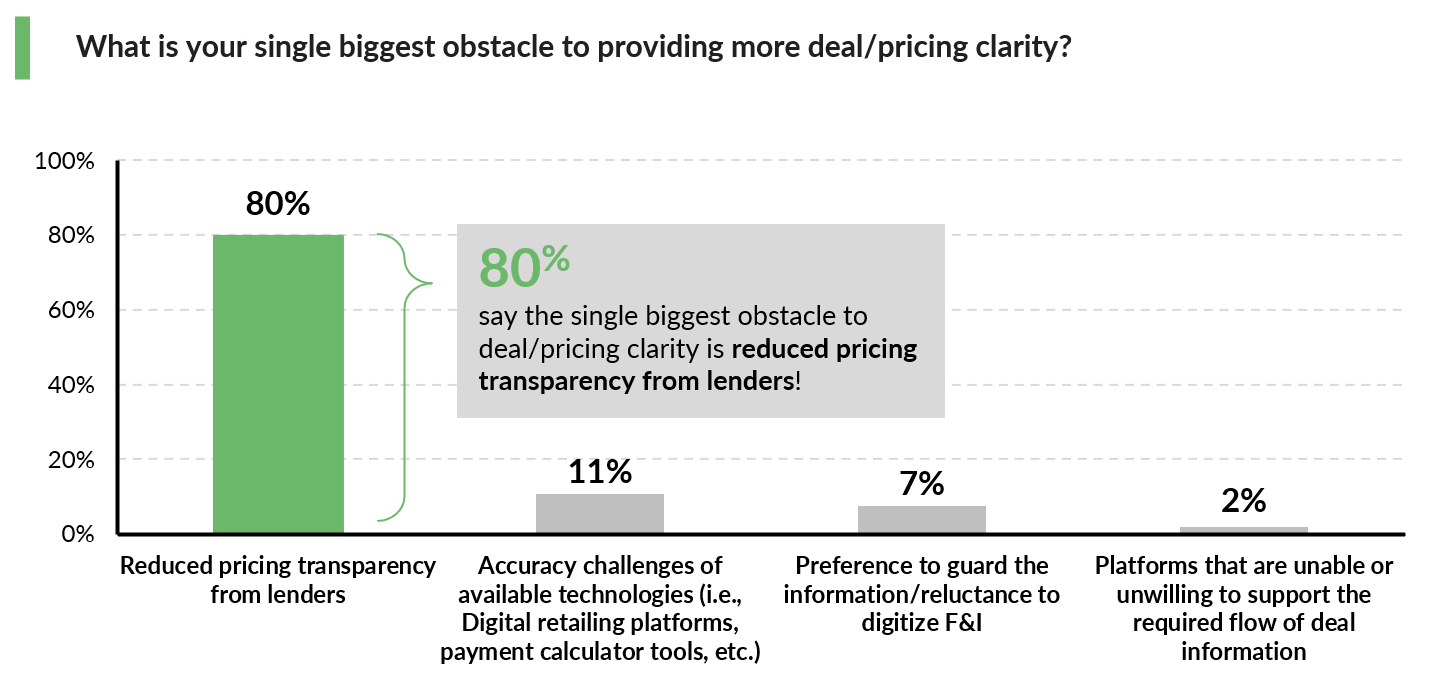

Eighty percent of dealer respondents cited reduced pricing transparency from lenders as the single biggest obstacle to providing more deal/pricing clarity; that was followed by accuracy challenges of available technologies (11%) and their own reluctance to digitize F&I information (7%) — a finding that certainly runs contrary to the stereotype of the auto dealer unwilling to leverage digital tools.

Dealers in the online survey, fielded by eLEND Solutions in July/August 2023 to over 350 dealers, saw lenders as an obstacle to trust: 84% felt that they were caught in the middle between customer demand for more transparency, and a decrease in pricing transparency from lenders.

According to the survey, this trust and transparency divide between consumers, dealers, and lenders is pushing retailers to rely on basic, and frequently inaccurate, payment calculator tools that exacerbate, rather than mitigate, the lack of transparency. Wanting to meet their customers’ needs, dealers are pushing forward with quotes: ninety-four percent say they quote customer payments before receiving lender loan decisions, and 85% before customers even come into the store. Lacking lender information, this often means they are quoting unqualified payment terms, unmatched to lender programs — a guessing game that adds friction and perpetuates the trust void during final deal negotiations.

“The reality is that once customers are in the F&I office, they often see payment promises unravel,” said MacInnis. “That just adds more conflict between dealer and customer. Many dealers want to facilitate pricing transparency early but, without accurate lender quotes, it just becomes another lead generation tactic — and a showdown that can impact both profits and CSI.”

The survey found that transparency is not just driven by lender preferences. While dealers

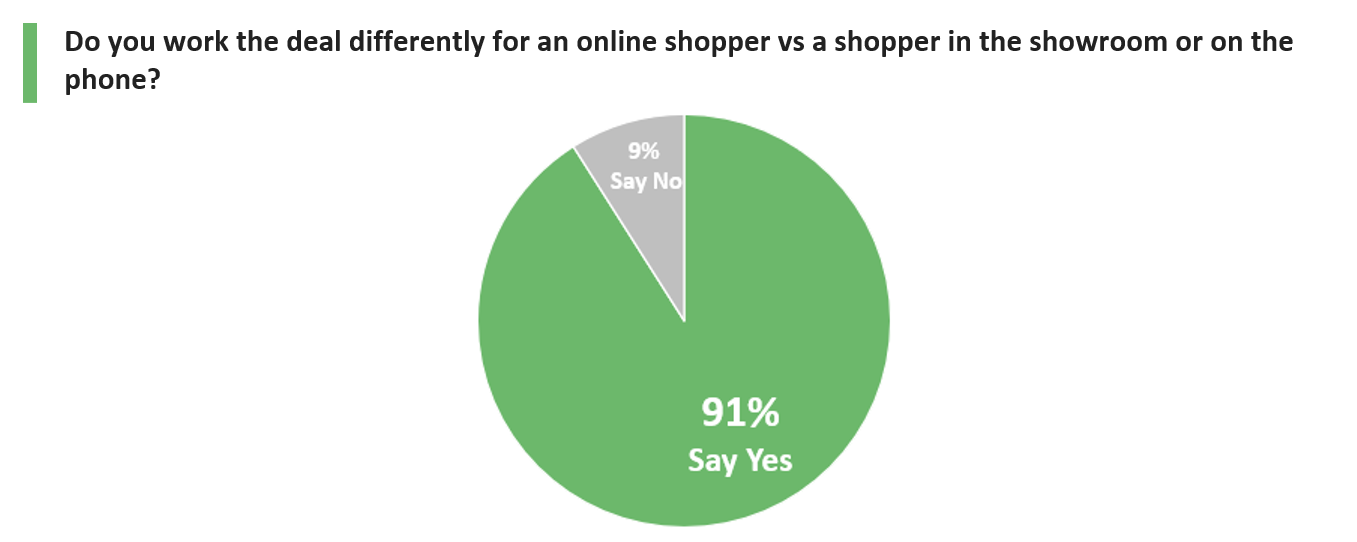

say they want to quote payments early, the vast majority (86%) continue with a ‘sales first, finance later’ process – and 91% of auto dealers say that they work the deal differently for an online shopper versus a shopper in the showroom or on the phone.

Although this tension between old and new sales approaches certainly adds to issues with trust and transparency, dealers are overwhelmingly interested in finding solutions: 95% see value in a pre-desking tool integrated with lender credit score models to help improve the ability to quote, upfront, more accurate and realistic deal terms — a step that will have a significant and positive impact on dealer/customer/lender relations.

Key Survey Takeaways

- 94% of dealers surveyed say that consumers and dealers define transparency

- 98% say there is a gap between how dealers want to sell and how buyers want to buy.

- 97% agree that there is a trust gap when it comes to arriving at “the” deal; 82% strongly agree it exists.

- 95% say that there’s balancing act between customer expectations of transparency and dealership financial success.

- 80% blame reduced pricing transparency from lenders as the single biggest obstacle to providing more deal/pricing clarity.

- 7% cite their own reluctance to digitize F&I information as the single biggest obstacle to providing more deal/pricing clarity.

- 84% feel caught in the middle between the customers’ increasing demand for deal transparency.

- and the lenders becoming less transparent.

- 94% say they quote customer payments before receiving lender loan decisions.

- 85% say they prefer to quote payments to customers before they come into the store.

- 93% agree that online customers want to know what their monthly payments will be before scheduling an in-store appointment.

- 86% continue with a ‘sales first, finance later’ protocol; 7% start finance and sales together at the front of the process.

- 91% say that they work the deal differently for an online shopper versus a shopper in the showroom or on the phone.

- 90% allow BDC or Internet Managers to negotiate finance terms with remote customers.

- 95% think a pre-desking tool integrated with lender proprietary credit score card models would add meaningful value.

About eLEND Solutions:

eLEND Solutions™ (formerly DealerCentric) is an automotive FinTech company providing a middleware solution designed to power transactional digital retailing buying experiences for the retail automotive industry. The platform specializes in hybrid credit report, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences - concluding with a transactable, fundable deal structure.

For more information, please visit www.elendsolutions.com.

Contact Media Relations:

Angela Jacobson, mWEBB Communications, (714) 454-8776, angela(at)mwebbcom(dot)com

Crystal Hartwell, mWEBB Communications, (714) 987-1016, crystal(at)mwebbcom(dot)com