AI and the Car Buying Process: Enhancing or Hindering?

Part 1: The Quest for Clarity

In an era where technology promises to streamline and enhance the car buying process, our newest survey of dealers and lenders unveils a critical paradox. The integration of AI-driven pricing decisions, coupled with diminishing lender transparency, is casting a spotlight on significant discrepancies that are adversely affecting the consumers buying experience. This blog reveals the dual culprits, pinpointing the alarming variances between desked deals and final lending decisions and their implications on the car buying process.

The Problem Unfolded: The Ripple Effect of Inaccurate Payment Quotes

A significant 86% of responding dealers and lenders from the survey acknowledge that inaccuracies in online digital retailing payment quotes are detrimentally impacting the car buying experience.

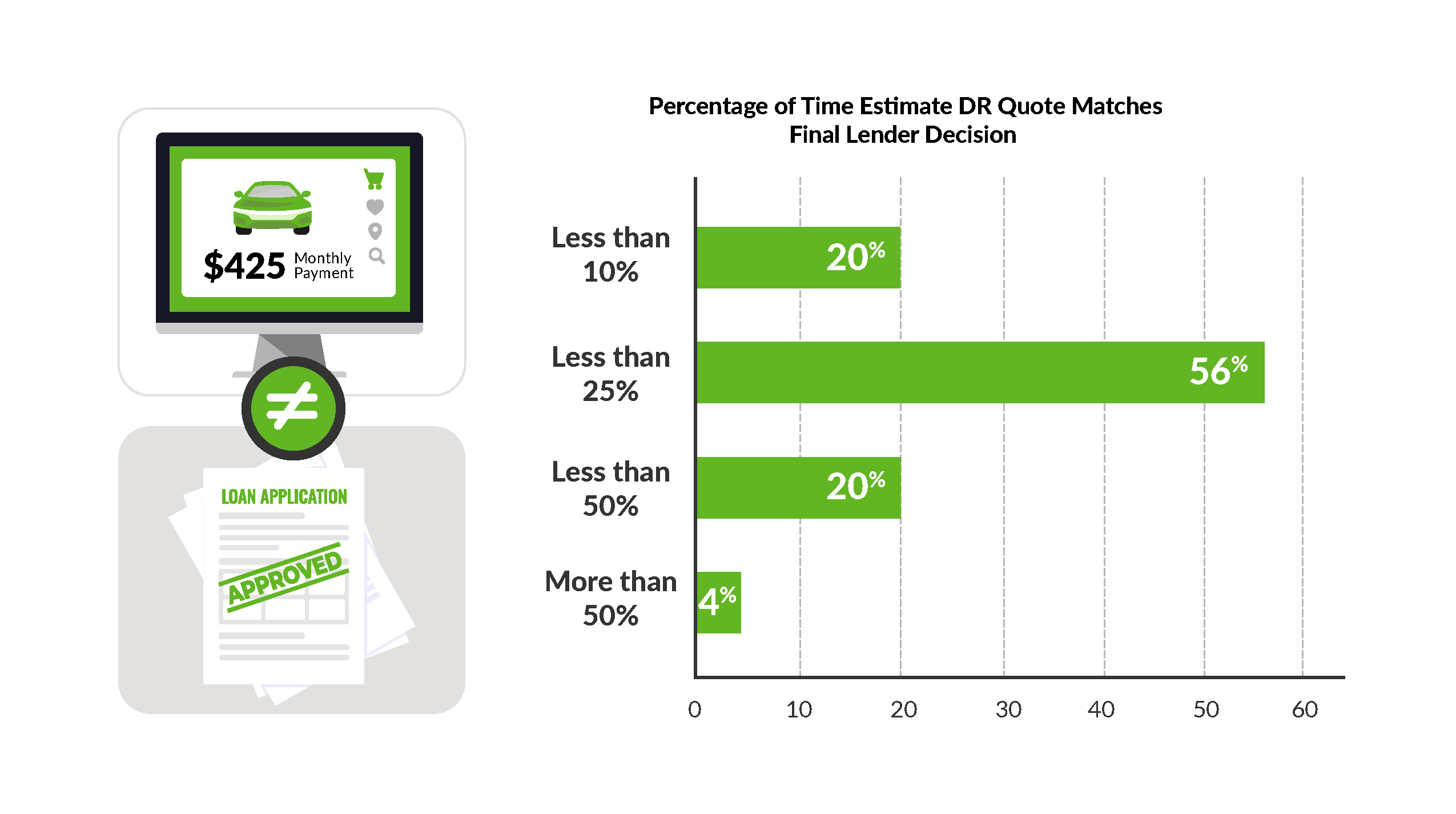

This issue is rooted in a stark reality: the majority (76%) of dealers and lenders report digital retail payment quotes align with final lender decisions less than 25% of the time – perpetuating confusion and distrust among buyers.

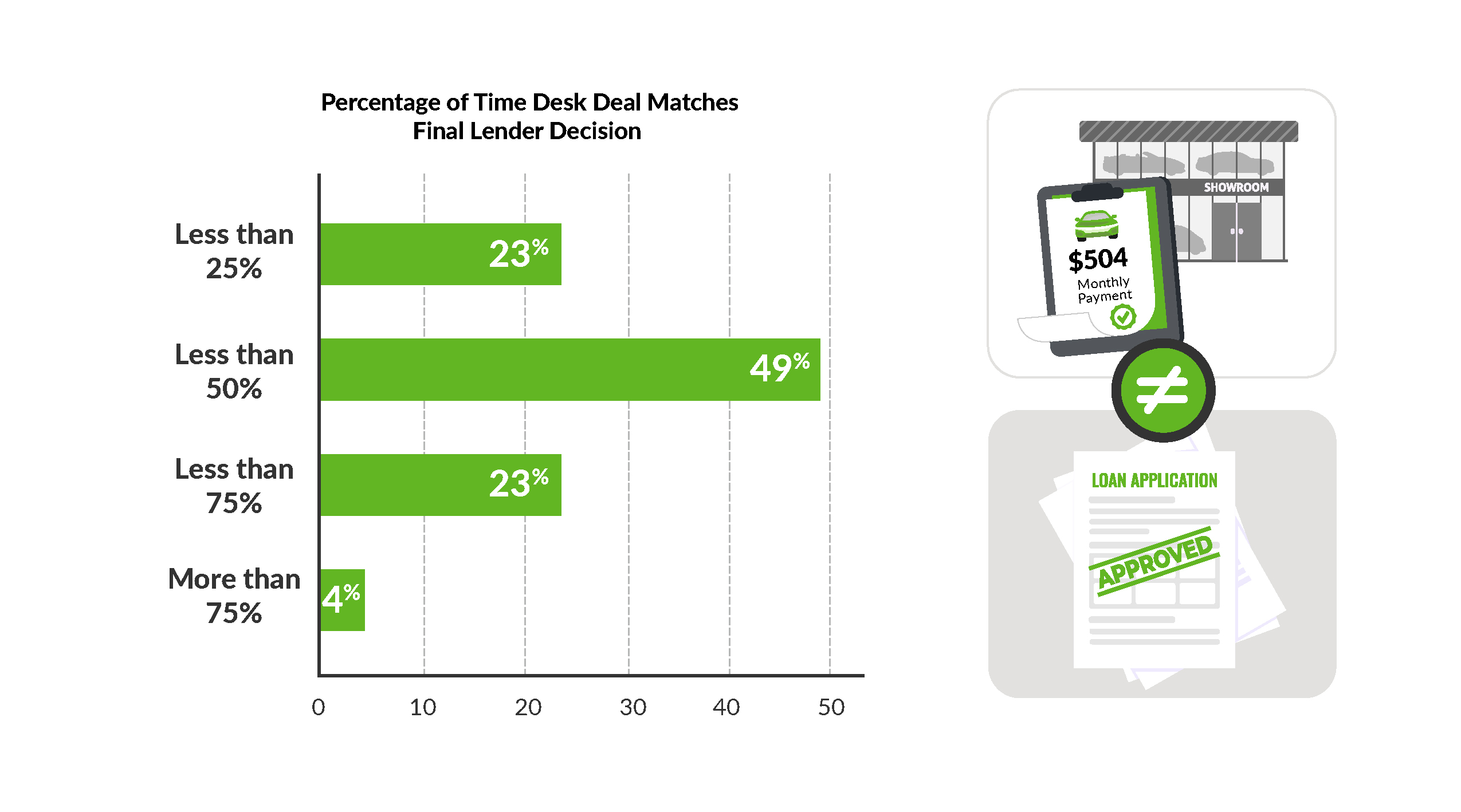

Exacerbating frictions in the car buying process, the desked deal matches final lender decisions less than 50% of the time.

The Discrepancy Dilemma: Two Culprits Emerge

1. The Shifting Pricing Paradigm

The shift from legacy credit tier band pricing to AI-based pricing marks a pivotal change in how loan pricing is determined. While legacy models rely on simplicity and standardization, categorizing borrowers into credit tiers, AI-driven pricing introduces a complex, personalized approach. AI-based pricing delves into a myriad of data points, offering a nuanced view of a borrower’s financial situation beyond traditional credit assessments – and even non-traditional data like social media activity or online behavior, to assess risk and determine pricing.

This table summarizes the differences between AI-based pricing and legacy credit tier band pricing:

FeatureAI-based_PricingLegacy Credit Tier Band Pricing

| Basis for Decision | Comprehensive data analysis including credit scores, income, employment, spending habits, and potentially non-traditional data. | Primarily based on credit scores, with some consideration of other financial factors. |

| Personalization | Highly personalized, with loan offers tailored to the individual’s financial situation and behavior. | Less personalized, with borrowers grouped into tiers based on their credit scores. |

| Pricing Flexibility | Dynamic pricing allows for real-time adjustments based on various factors. | Fixed pricing based on predefined credit tiers, with less flexibility for real-time adjustments. |

| Efficiency | High efficiency and speed in loan processing due to automation and real-time data analysis. | Lower efficiency compared to AI, with manual processes for adjustments and decision-making. |

| Transparency | Potential issues with transparency due to the complexity of algorithms and data analysis methods. | Higher transparency, as loan offers are based on clearly defined credit tiers and criteria. |

| Potential for Bias | Risks of algorithmic bias if models are not carefully designed and monitored. | Bias is primarily linked to traditional credit scoring methods and their limitations. |

| Regulatory Compliance | Must ensure algorithms comply with lending laws and regulations, including fairness and privacy. | Compliance is more straightforward, focusing on fair lending practices based on credit scores. |

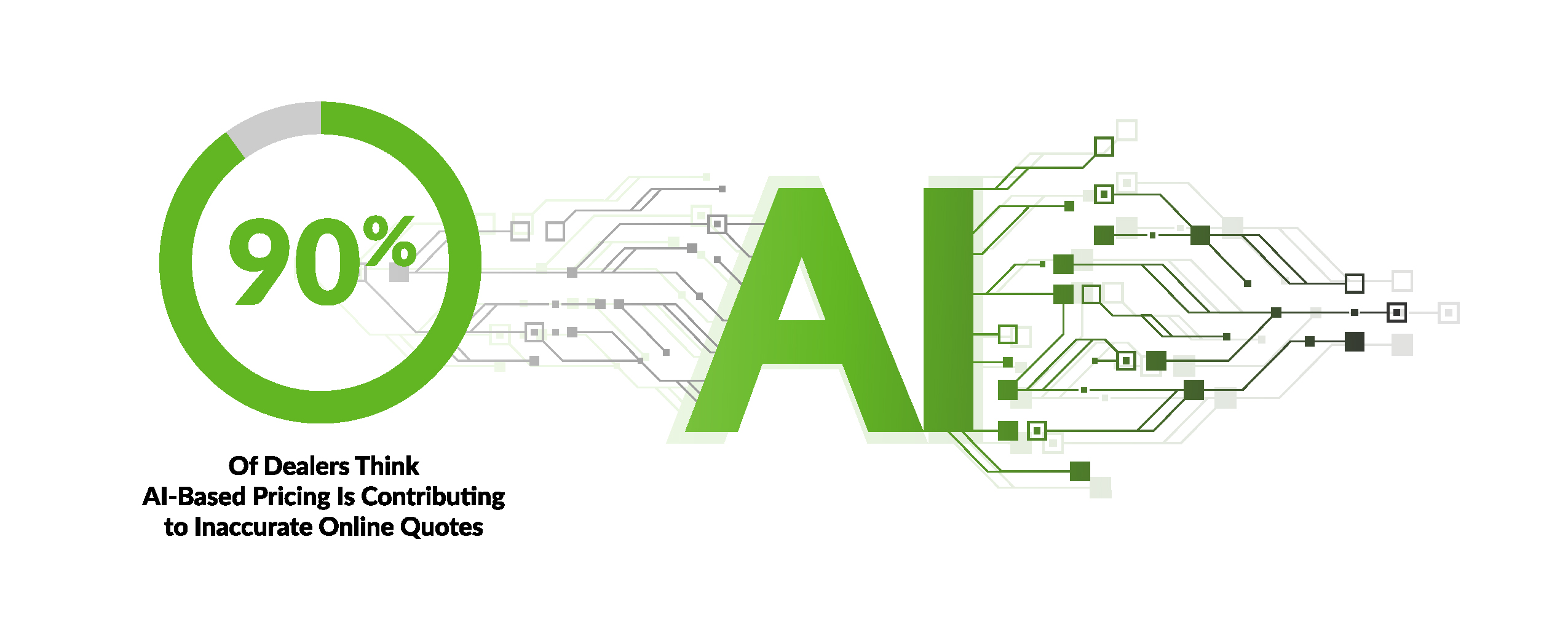

This transition introduces variability and unpredictability into the financing process. The reliance on AI-powered pricing has led to a significant disconnect, with an overwhelming 90% of survey respondents citing it as a contributor to payment quote inaccuracies.

2. The Noticeable Reduction in Lender Transparency

Compounding the issue, nearly as many respondents cite the decline of lender provided rate-sheet pricing bulletins. This shift exacerbates the issue, creating a landscape ripe for misalignment – leaving dealers and consumers navigating a maze of ‘deal’ uncertainty.

Conclusion:

The shift from legacy credit tier band pricing to AI-based pricing, combined with reduced transparency from lenders, represents a significant transformation in the automotive finance industry, with profound implications for the car buying process.

The evolution presents both opportunities and challenges. While it promises more personalization and the potential for broader access to financing, it also brings complexities that impact dealer-lender relationships and require increased transparency, consumer education, and regulatory oversight to ensure the benefits are realized without compromising fairness or consumer trust.

This blog is Part 1 of a two-part series, and lays the groundwork for understanding the complexities and challenges at the intersection of the lender, the dealer, the consumer – and the deal. Find out more in Part 2 which includes more data on why today’s online payment quotes are anything but ‘penny perfect’ and offers insights and opportunities to bridge the gap between digital innovation and the value of transparency and trust in the car buying process.

Source: 2024 survey of over 300 auto dealerships and lenders across the U.S., fielded by eLEND Solutions

About The Author

Pete brings 40+ years of experience in automotive finance and technology as Founder and CEO of eLEND Solutions™, an automotive FinTech company providing a middleware solution designed to power transactional digital retailing buying experiences. The platform specializes in hybrid credit report, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences - helping dealers sell more cars! Faster!

Share this:

Recent Posts