Why Are Some Dealers in the ‘Back Seat’ Regarding DR?

Imagine someone walking into your dealership – perhaps a consultant or vendor – and suggesting that you are operating your dealership wrong. Immediately, you’d be fiercely defensive and most likely question their credibility, knowledge, and intentions. After all, your operations have been financially successful for years, even decades or generations.

That is how a lot of dealers feel about digital transformation and digital retailing. And to be fair, it is understandable that most dealers are slow to adopt new technologies that risk profitability and reluctant to make serious changes to the retail status quo. In an industry that grew up believing you control the customer and therefore the deal – giving up any control and abandoning old-school thinking is extraordinarily difficult.

But unlike previous industry ‘shiny objects’, most would agree evolved customer shopping experiences and preferences – combined with the tremendous change experienced by the retail automotive industry in response to the pandemic, and emerging competitive business models like Carvana – car buyer expectations have been permanently altered and there’s no going back.

Today, your biggest competition is the status quo. So, what stands in the way for dealers?

Digital Transformation: Upsetting The Status Quo Has Its Challenges

There is a tendency in the industry to think of digital retailing as an opportunity most easily solved with the best available technology. There is little doubt that selecting the right technology is important – but the reality is – what dealers do with the technology is so much more important.

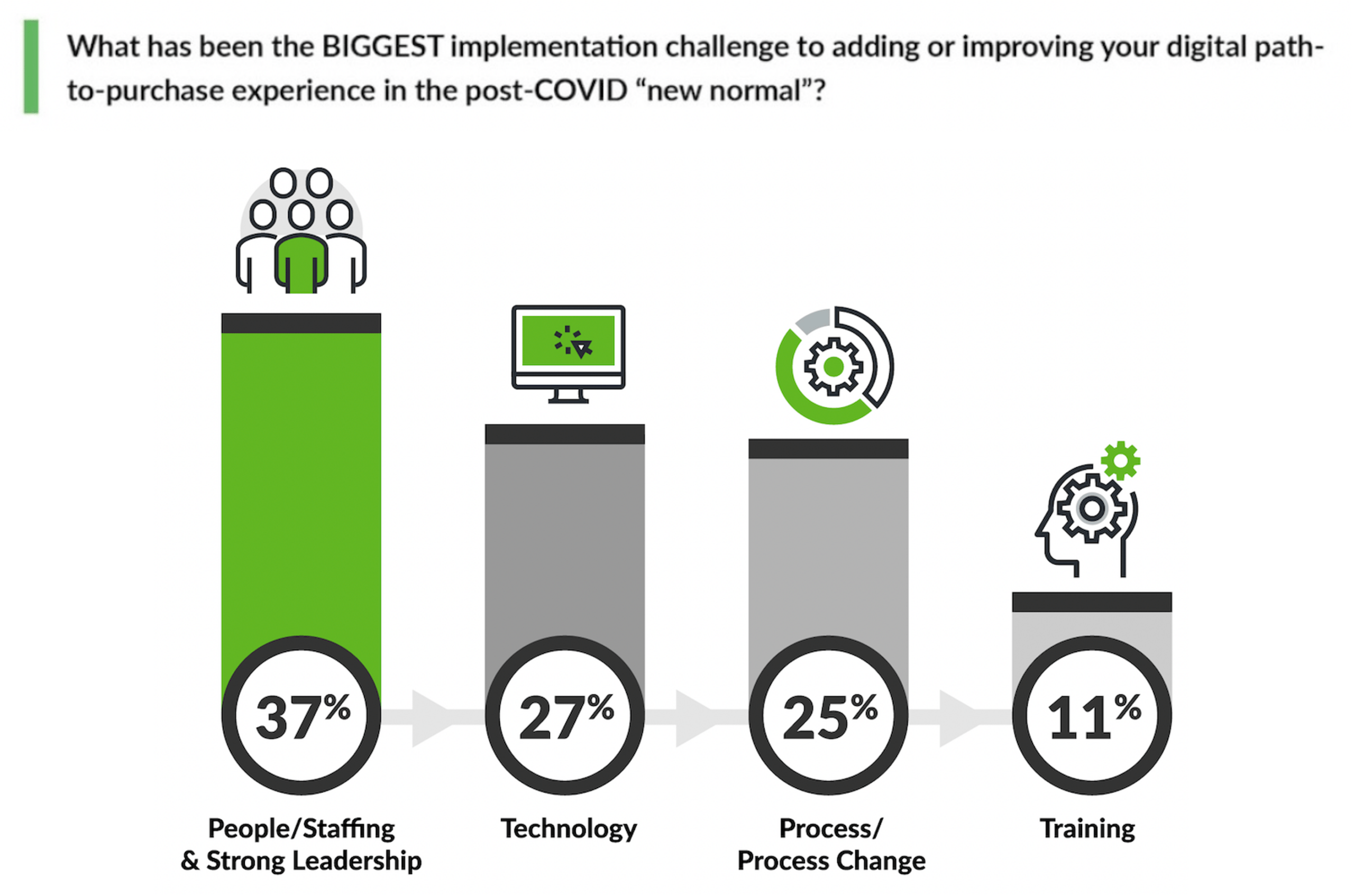

According to the 2021 eLEND Solutions Digital Retailing Study dealers reported their biggest barriers to a successful DR transformation are:

- People related challenges

- Technology deficits

- Required process/workflow changes

Digital Transformation Roadblocks & Speedbumps

1. People Related Roadblocks

People/staffing challenges (i.e. Missing leadership buy-in, employee/manager resistance to change, staffing mismatches, recruitment issues, etc.) are the #1 obstacle to a successful DR transformation.

A. Lack of Leadership

The most successful businesses in every industry build customer experiences around what the majority of customers want.

Dealers are scrambling to re-think business models and reinvent their retail experience due to the consumers overwhelming preference and expectation for an increasingly digital and transparent sales process. But that’s easier said than done. “Dealers are show-me-first” says Brian Benstock, VP/GM of Paragon Honda & Paragon Acura. “And today there’s not necessarily a clear path – even among the OEM’s”

Many talk about an Amazon or Apple-esque buying experience but those business models do not facilitate highly considered purchases or require complex deal structuring and financing. Those are unrealistic comparison expectations, but few would argue an evolution is long overdue. “We are not competing against each other but competing with the other experiences that customers have. We aren’t going back to the way things were” says Benstock.

Most dealers, including many of the larger dealer groups, aren’t equipped with the people, processes, or technology to deliver a more convenient, customer-first, digital path-to-purchase buying experience. So a sustainable transformation – one that inevitably will require a process, staffing, culture and technology evolution – requires a business model reinvention and leadership-led, top-to-bottom commitment.

It is a balancing act between the customers’ expectations and your dealership’s success. And because so many in our industry today only know what they learned pre-Internet, and certainly what they learned pre-pandemic, the required changes may be too much for many managers, and some dealers.

B. People/Staffing

Even during more normal times, dealers will say the biggest challenge in their variable departments is the costly talent gap – their inability to attract talented salespeople, especially Millennials and women. The hidden costs of high salesperson turnover, poor customer interactions and lack of commitment to the dealership, likely totals as much or more than any margin compression.

Creating ‘customer-first, digital first’ buying experiences can compound these challenges. How? With more steps of the buying experience occurring away from the dealership, digital retailing will inevitably change the traditional role of dealership salespeople (and F&I Managers and BDC agents). Selling cars will always be a relationship business, but with the buyer having more control of the process and doing it remotely, the salesperson is no longer in the business of selling cars. They are in the business of helping customers buy the car.

In practice, this means focusing on the customer and making the relationship more important than the deal. It means salespeople will need to be less ‘transactionally’ motivated. Online car buyers need nurturing, not closing. They will need unbiased guidance to navigate their many choices in a very complex transaction. What they don’t want or need is pressure and advice steered by pay plan considerations.

This shift requires a re-think of primarily commission-based pay plans but also the potential of creating staffing mismatches. Staffing mismatches occur when existing skill sets do not match well with re-defined job roles and responsibilities. This creates recruitment opportunities but also the potential for recruitment issues – exacerbated by our economy and an industry that does not have the best reputation with consumers (especially Millennials) and a perceived gender bias that could be turning away half of the available talent pool.

2. Technology Roadblocks

For dealers (and OEM’s),, selecting and onboarding the right eCommerce technology stack that enables a remote digital-path-to-purchase experience that doesn’t require a dealership visit – is among the most strategic decisions a modern auto retailer will make, not to mention a monumental endeavor. The two biggest challenges are:

- Finding the right technology to power the entire transaction online and

- Missing or problematic integrations.

A. Finding the Right Technology Platform

If the longer-term end goal for the retail automotive industry is true eCommerce, the industry will need to find technologies that simplify the process and create efficiencies for both buyers and dealers

It’s an exaggeration to say any current platform is truly end to end. For one thing, many states require a “wet signature” on sales contracts, meaning a physical signature. But different platforms have refined different parts of the sales experience to meet expectations of younger generations.

Today, most dealers allow customers to perform initial car purchasing steps remotely, but there is a significant drop off in ‘offered’ digital capabilities as the buyer moves closer to ‘the’ deal ( i.e., digital F&I). Some of the limitations are due to the dealers own resistance to digitize F&I. But the much more intricate and expensive challenge is building or finding the right technology that enables the entire transaction – including the complex deal structuring, financing, and contracting elements.

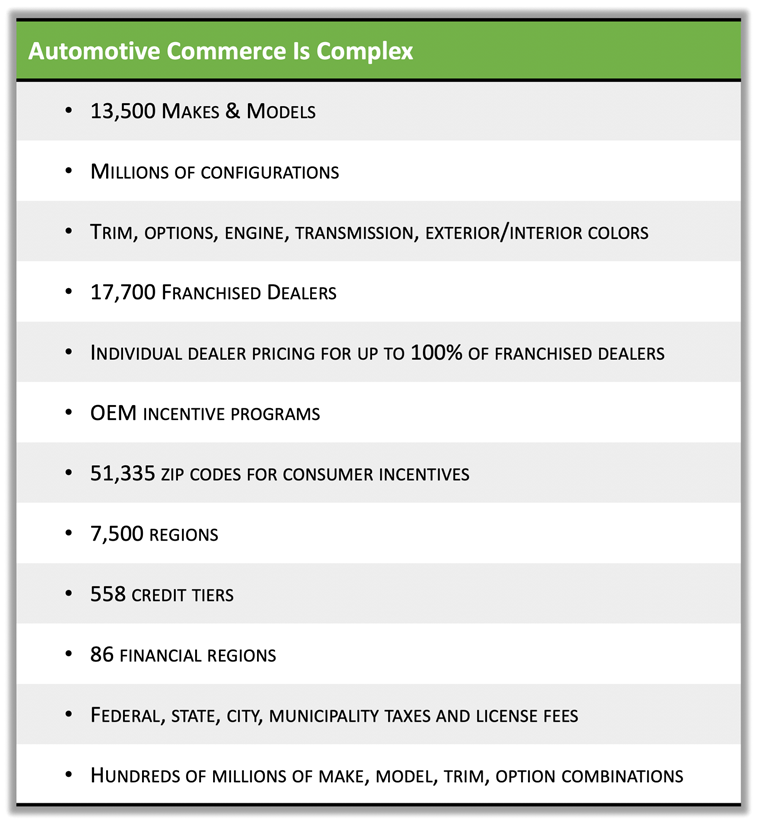

Consider for example, there are over 13,500 makes and models of new cars. Just new cars. And according to the AN 2020 Automotive eCommerce Report, there are hundreds of millions of make, model, trim, color option combinations.

To add to the complexity, the industry is regulated under strict federal and state advertising laws, franchise rules and brand compliance requirements, which makes it extremely difficult to calculate “to the penny” transactions on millions of cars that are legal in all 50 states and compliant with all franchise rules and brand guidelines.

B. Missing Or Problematic Integrations

In theory, with online retailing tools, the combination of technology and data should enable the dealer and the customer to come together much faster. The intended benefits are many, including greater than before sales volumes, improved sales throughput, higher F&I product uptake, faster transaction times, and higher customer satisfaction. However, though the intent is there, commonly the functionality is not.

Some DR tools are primarily online but there are no in-store mobile or desking tools. Or just the opposite. Some DR providers offer an amazing showroom experience, but they don’t have a widget or an integration on the website that allows a seamless online to in-store transition.

Another challenge is the inconsistent API capabilities across the various DR solutions, CRM, DMS, FMS and Inventory platforms. In these situations, API’s exist but their ability to support the real-time, bi-directional information flow/exchange across platforms (pitch and catch) does not.

Missing or problematic online integrations across the various platforms involved in the sales and finance deal flow, create information disconnects, experience gaps and significant profit leaks. The disconnects create process redundancies and inefficiencies that are hugely frustrating to consumers and all but erase the intended benefits of DR for dealers.

3. Process/Workflow Roadblocks

The traditional way of selling cars was a process built by dealers for dealers. The idea that a customer could be almost as knowledgeable as the salesperson – and a traditionally manual, paper-based sales process would be digitized and facilitated away from the dealership – is more than most Owners & Dealer Principals ever imagined.

If you’re like most, you are invested in an industry you know and love, and in some way, it hurts to see it changing. But with a new normal, comes new opportunities…and everybody wants access to speed, convenience, and transparency – not just millennials.

Creating a Unified Car Buying Experience

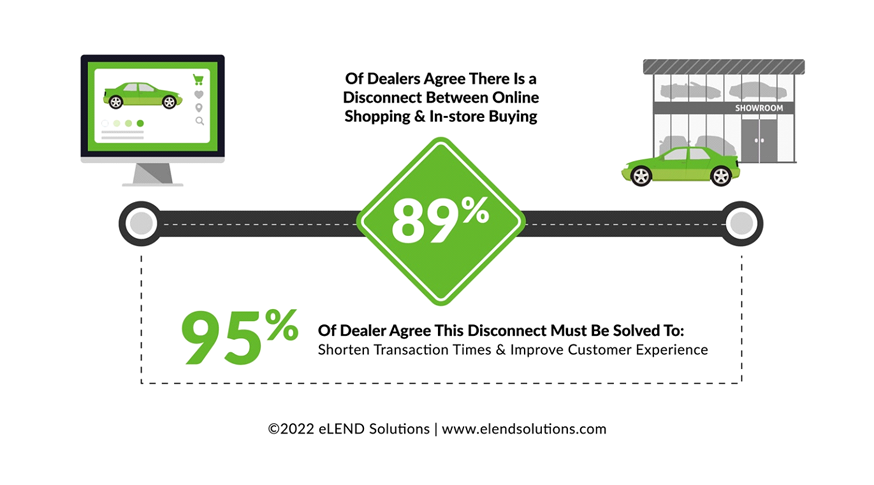

If profits are determined by sales and sales are determined by sales process, there’s little doubt the greatest obstacle to success and customer satisfaction is a disconnected online to in-store buying experience filled with information gaps, process redundancies and wait times.

A customer-centric, technology enabled sales process requires a holistic approach — viewing every piece of the process as connected and complementary. It means connecting the online experience and the showroom experience to create ONE unified buying experience. The transformation has proven to be easier said than done.

A. The Online To In-Store Transition

Digital retailing done right should allow the customer to move themselves down-funnel online by creating a clear path to purchase that gets them closer to the sale – and pick up where they left off when they get to the dealership.

But fully digitizing the transaction can only happen if these online retail tools are connected with the platforms involved in the dealers’ sales and finance deal flow. Unfortunately, it is common for many DR tools to stand-alone and not be well integrated with the dealers CRM, DMS, Desking and Finance Platforms.

Beyond individual vendor API capabilities – seamless, secure data exchanges between platforms can only happen if vendors choose to cooperate. Service providers would have to move to an open integration model and vendors would have to choose to collaborate for the transaction to be fully digitized. And for (3) reasons, that cooperation is unlikely:

- Vendors more interested in protecting the status quo

- Vendor competition makes cooperation unlikely

- Vendor propensity to ‘own the space” and hoard the information

- Vendor resistance to invest/support open API technologies

Bottom line, it would be difficult for Dealers to evolve if their vendor ‘partners’ don’t also evolve.

B. Poor Customer Interactions

As the auto industry evolves from lead generation to a transaction-based business model, leading dealers are moving away from lead capture strategies and using DR tools and real time, advanced chat, messaging, and video solutions to accelerate deal creation. What should come next is for in-store processes to be aligned with expectations established online – but most dealers aren’t ready for what comes next.

Salespeople not having access/visibility to the information provided or the steps completed online. – and other process/workflow gaps – leave DR customers treated no different than a cold walk-in. So the remote customer who has spent hours completing many steps of the transaction prior to the dealership visit, thinking they would be saving time at the dealership, has to start over!

C. Different Buyer Preferences Require Flexibility

Thinking about what the customer wants to do, not what you want them to do – means that a unified sales process needs to be flexible enough to meet all your customers’ needs. Buyers are always going to prefer to shop and transact on their own terms, including these three main buying scenarios:

-

- Traditional: This customer wants to do everything in person at the dealership.

- Hybrid: This shopper wants the best of both worlds. They complete the steps of the car buying process they enjoy in person at the dealership, but they would rather complete some tasks online.

- Digital: This customer would prefer to complete the entire car buying process remotely, without ever physically stepping foot into the dealership.

D. DR Success Is Not Easily Replicated and Scaled

Every dealership is responsible for developing the processes and workflows that work best for their store. What works for one dealership isn’t necessarily going to work for the next. Every store has their own unique sales and service propositions; their own culture; their unique trading area demographics, and franchise rules and brand requirements.

Any digital retailing strategy must be tailored and tweaked in a way to best fits the dealership where it’s implemented – it likely won’t be the exact same process or experience for any two stores, even in the same dealer group!

About The Author

Pete brings 40+ years of experience in automotive finance and technology as Founder and CEO of eLEND Solutions™, an automotive FinTech company providing a middleware solution designed to power transactional digital retailing buying experiences. The platform specializes in hybrid credit report, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences - helping dealers sell more cars! Faster!

Share this:

Recent Posts