Digital First, Credit First Customer Experience

Improving the customer experience and transforming the transaction are not limited to offering digital buying capabilities for remote buyers. If profits are determined by sales and sales are determined by sales process, there’s little doubt that the greatest obstacle to success and customer satisfaction is the time it takes to complete the deal structuring and F&I portions of the car-buying process. Based on research, the biggest opportunities to improve the in-store customer experience are:

- Creating greater information flow between the Sales and Finance departments

- Improving the speed and quality of the customer’s transition from Sales to F&I

- Reducing the time the customer spends in F&I

As part of a digital first customer experience, starting sales and finance together at the same time – can address these opportunities.

Credit First vs. Credit Last Customer Experience

Traditionally, most dealerships have by design, operationally separated Sales and F&I – dictating a process wherein F&I is not engaged until after they have four-squared the deal.

In fact, in a eLEND Solutions survey of U.S. based dealers, 57% of dealership respondents reported that Sales closes the ‘deal’ without credit pre-qualification or pre-approval. In a traditional process built by dealers for dealers, credit and finance conversations are saved for the F&I professionals to work out in the box. This is a ‘credit last’ path-to-purchase.

For many dealers, controlling the customer and the deal has made them financially successful. Dealers can and should and will run their businesses the way they want, but there is an opportunity to reverse-engineer an old-school workflow that increases closing ratios, PVR and customer satisfaction – while reducing the F&I time delay.

Improving the Customer Experience

According to a Cox Automotive Study, 90% of US buyers are payment buyers. Meaning for today’s car shoppers, affordability matters and deal transparency is just as important as price transparency. For dealers, ‘transparency’ translates to improving the customer experience by providing an upfront and honest transaction. Changing stereotypes and transforming the transaction starts with presenting real numbers. Real pricing. Real payments, rates and terms. Real trade equity.

Factors that affect accurate payment, rate and term quoting:

- Credit, Ability and Stability Eligibility

- Vehicle Selection (new/used)

- Type of Financing (lease/loan)

- Trade-in Equity (+/-)

Soft credit pulls, available from all credit repositories and most credit resellers, do not require a customer’s DOB or SS#, and do not affect the customer’s credit score. Requiring only the customers’ name and address, soft-pulls provide an upfront snapshot of the customers’ credit profile, and insights into their buying power before you start working the deal.

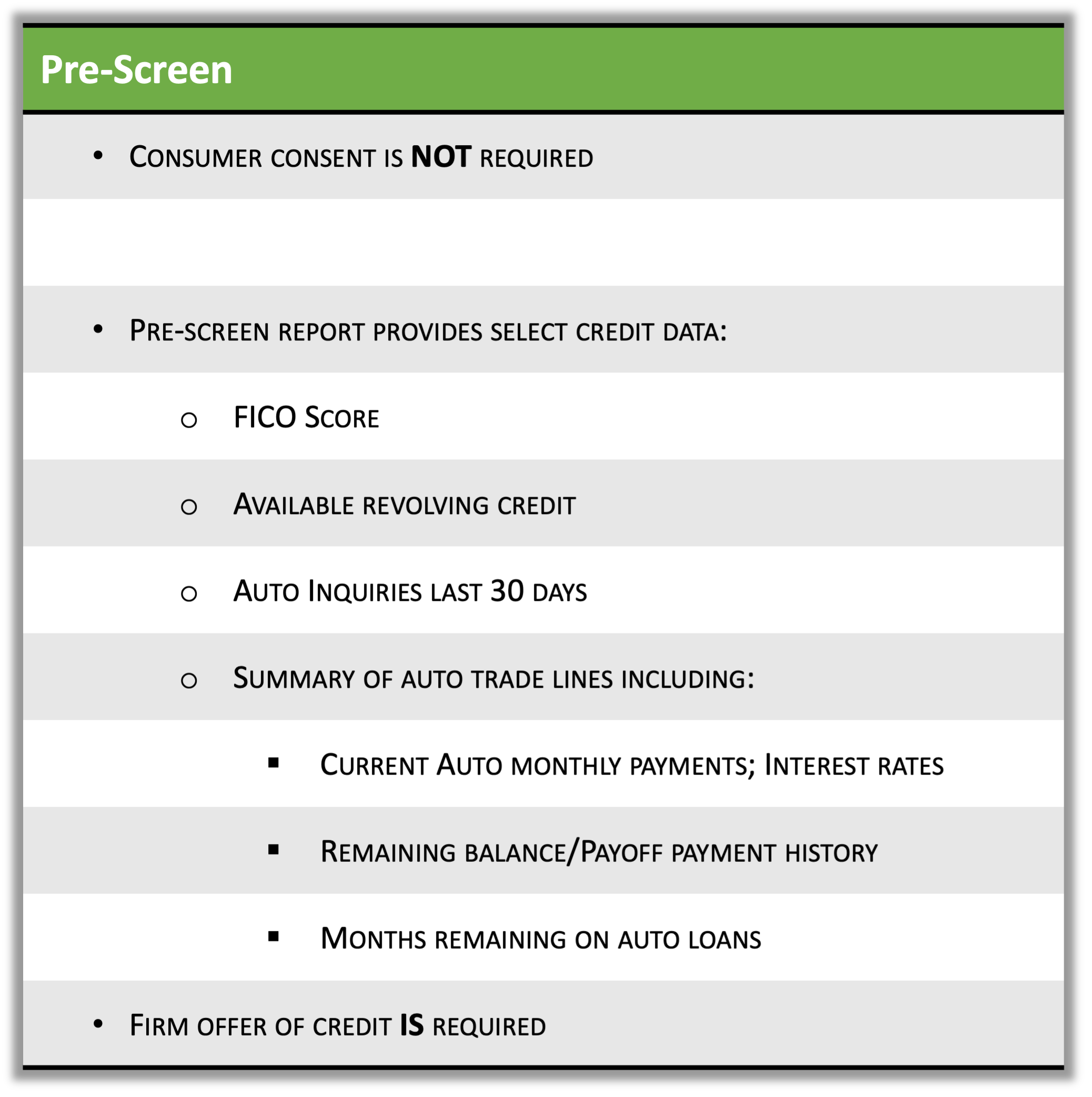

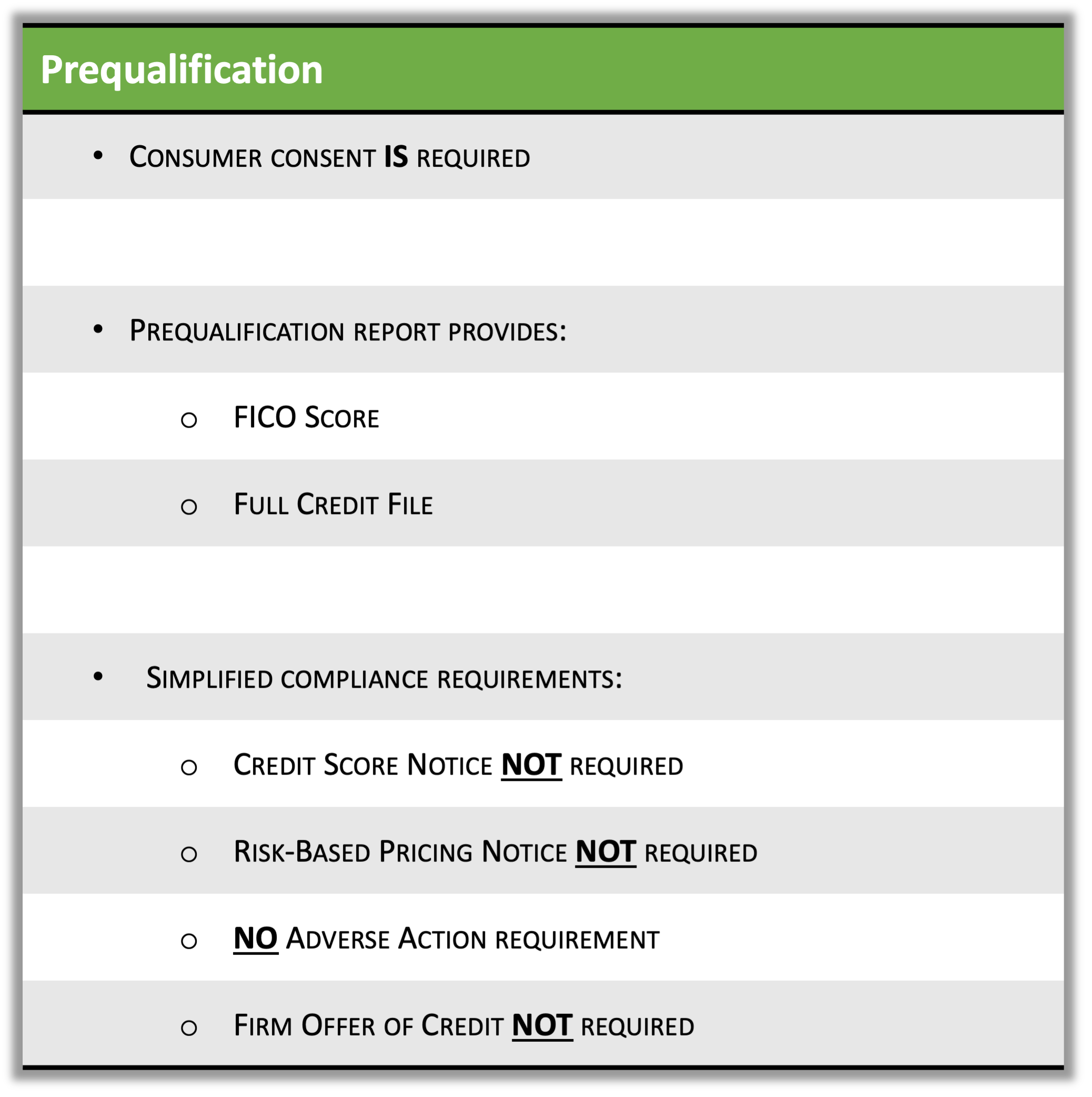

There are (2) soft credit inquiry types: Dealer initiated pre-screens and consumer consented pre-qualifications). Both provide insights into the customer’s credit worthiness and start the deal right, but they are not the same. It is important to understand the differences and protect your store from potential compliance and security risks.

Difference Between Pre-Screen & Pre-Qualification Solutions

Credit soft pulls are not a replacement for a hard inquiry and the report is not shared with the lender but unless you have a 100% closing ratio, the soft credit pull will save time and monthly credit report expenses by eliminating the FICO surcharge and the simplified compliance requirements.

Soft pulls also allow you to work deals in stealth mode, eliminating trigger leads to your competition.

Note: For even more buyer and seller convenience, advanced Identity verification solutions can instantly capture, digitize and authenticate the scanned driver license data in one simple step that takes seconds – and convert the scan into a pre-screen or consumer consented pre-qualification. These solutions work for both in-store and remote shoppers/buyers.

Both soft credit pulls and identity verification solutions accelerate the transaction while also minimizing frictions and protecting your dealership from compliance and identify fraud risks

Sell the Way Your Customer Wants to Buy

As part of credit first, customer-centric buying experiences, introducing credit qualified financing options early in the sales process, enables you to easily move your customer’s focus from the price to monthly payments that they can afford. If you provide details on different financing options and the required down payment/monthly payment combinations, the discounting will no longer be part of the conversation.

By overlapping the sales and finance functions, the faster and more profitably the deal can be structured. Sales working with finance can re-work the four square (including repayment terms, required down payment and/or dealer participation) so that discounting is not required to satisfy your buyers goals. If the customer wants a $450 payment, find the car and terms that makes that happen (with a VSC and/or GAP included if you can).

Additionally, customers can be comforted and reassured that they are approved before getting to the finance office. Quoting accurate, qualified numbers is also a trust multiplier, helping you and the customer come together much faster – and preventing unavoidable conflict when unrealistic payment expectations can be honored in the finance office. The upfront ‘transparency’ means fewer rehashes and unwinds, saving time in the box, allowing finance to sell more F&I products and handle more deliveries – and dramatically improving the customer experience.

The Transformed Customer Experience

Both ‘credit first’ and ‘credit last’ approaches have merits but your ability to meet the customers’ experience expectations starts with ‘credit first’.

In other buying experiences that include expensive, highly considered purchases or require complex deal structuring or financing – other than retail automotive – shoppers are encouraged to engage in the process after getting pre-approved or even pre-arranging their financing. The advice seems less predatory, more customer benefit focused, and reduces the time spent at the dealership. It’s everything today’s car shopper is asking for.

Introducing finance prior to working the deal shouldn’t be considered a speed bump on the road to the sale. Every customer has a stereotype about the car-buying experience. Quoting accurate, qualified numbers is a trust multiplier, helping you and the customer come together much faster – and preventing unavoidable conflict when unrealistic payment expectations can not be honored in the finance office.

Everybody wants to be more efficient and save time, not just consumers. Prequalification and Pre-screen solutions both accelerate engagement and conversions Evolve at your own pace but the transformed transaction and customer-centric buying experiences improves closing ratios, increases PVR/CSI, and creates efficiencies leading to faster transaction times by putting your buyer in the right car and right deal structure right away.

About The Author

Pete brings 40+ years of experience in automotive finance and technology as Founder and CEO of eLEND Solutions™, an automotive FinTech company providing a middleware solution designed to power transactional digital retailing buying experiences. The platform specializes in hybrid credit report, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences - helping dealers sell more cars! Faster!

Share this:

Recent Posts