In the (sort of) Post-Pandemic New Normal, Where Does Digital Retailing End?

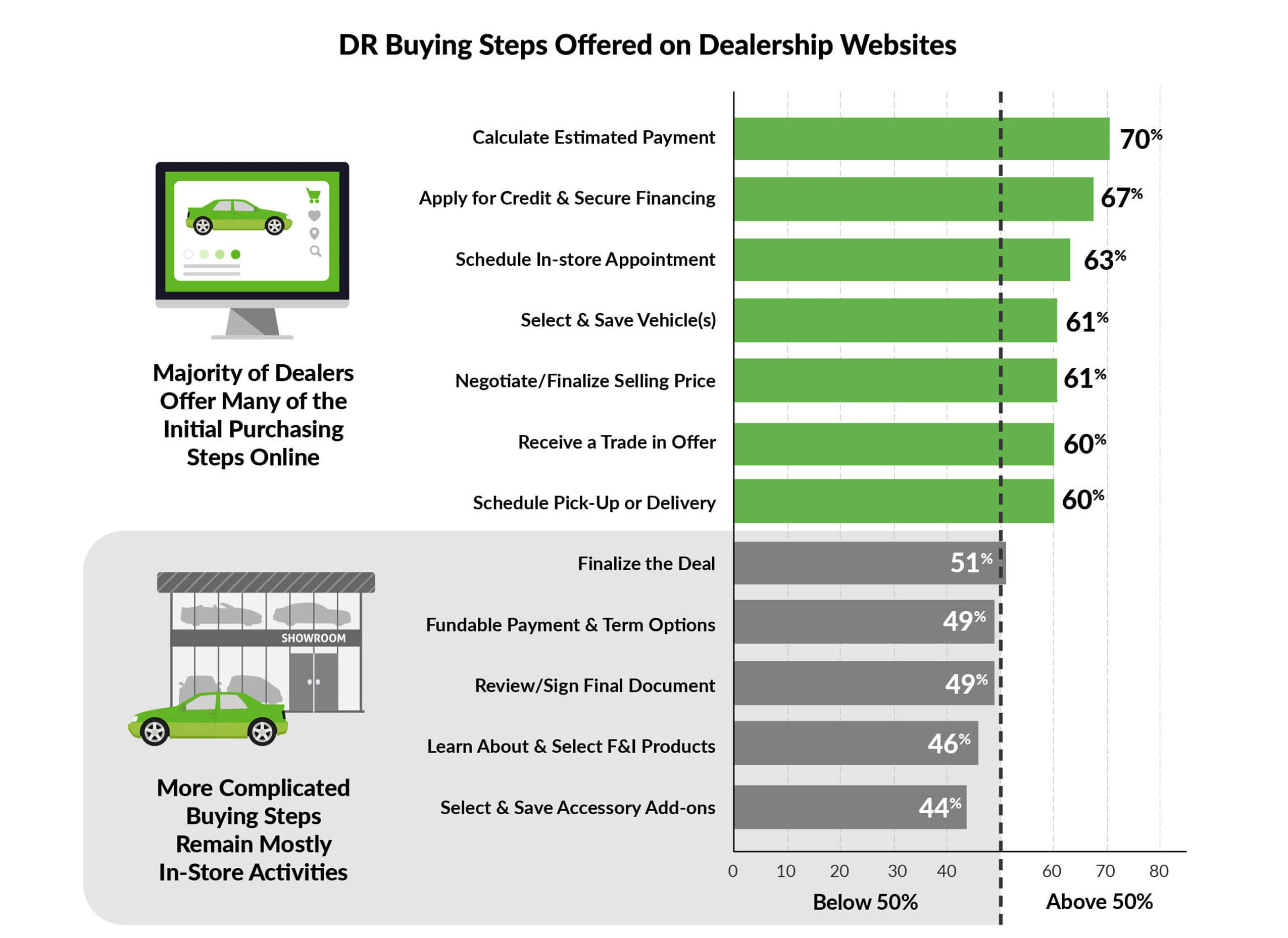

Approximately two-thirds of dealers are allowing their customers to complete many steps of the car buying process online but, for the more complex steps, the majority of dealers are still forcing/requiring a dealership visit.

The Change to Digital is Here to Stay

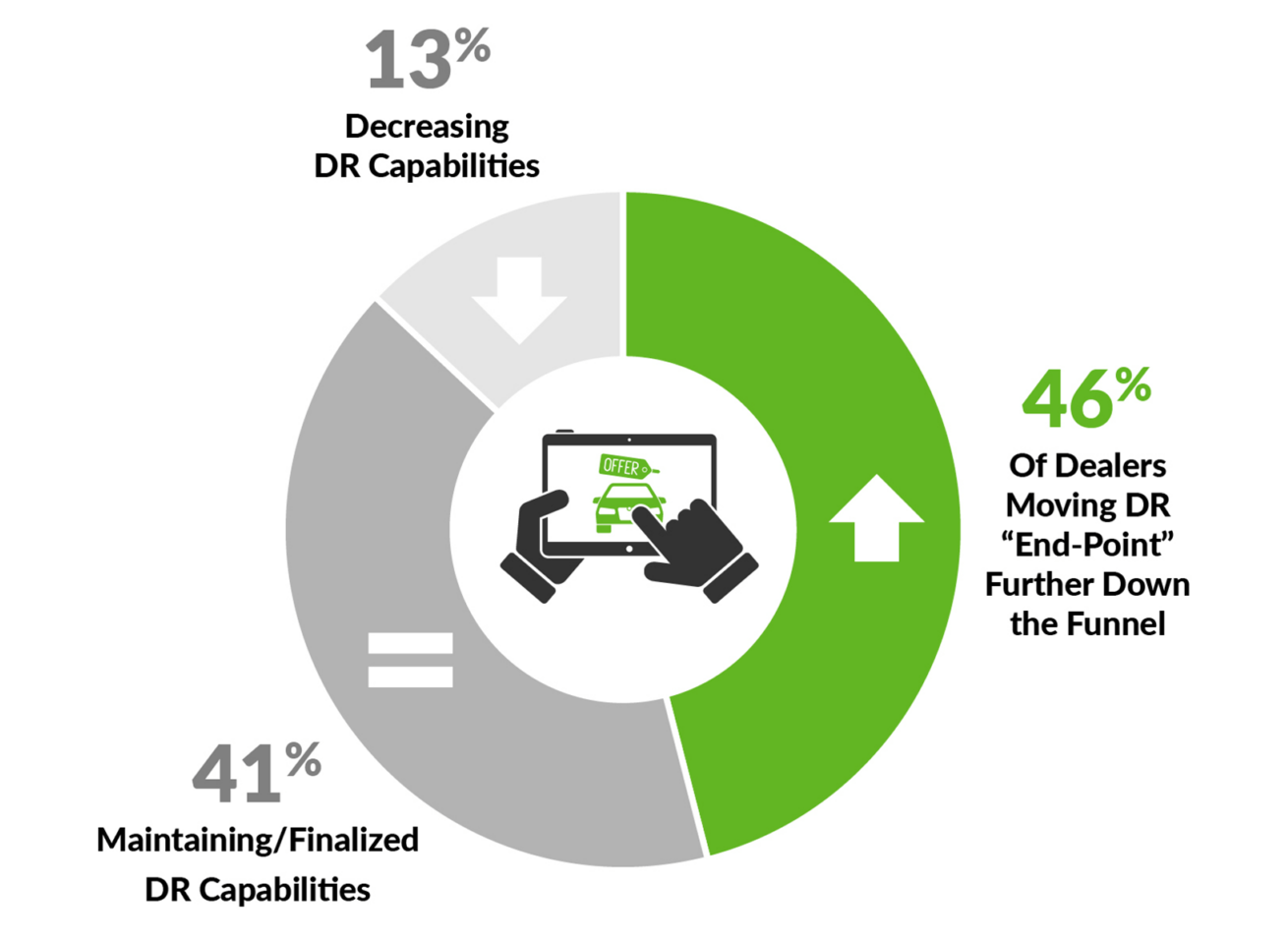

Nearly half (46%) report moving their DR ‘end point’ further down funnel since COVID-19 lockdowns and restrictions have eased. Another 41% report that they continue to offer digital buying capabilities, but have not advanced those capabilities. Only 13% of dealers report they reduced the number of buying steps completed online — an indication the industry has permanently changed with no going back.

Journey Stops Short of True End-to-End Digital Buying Experience

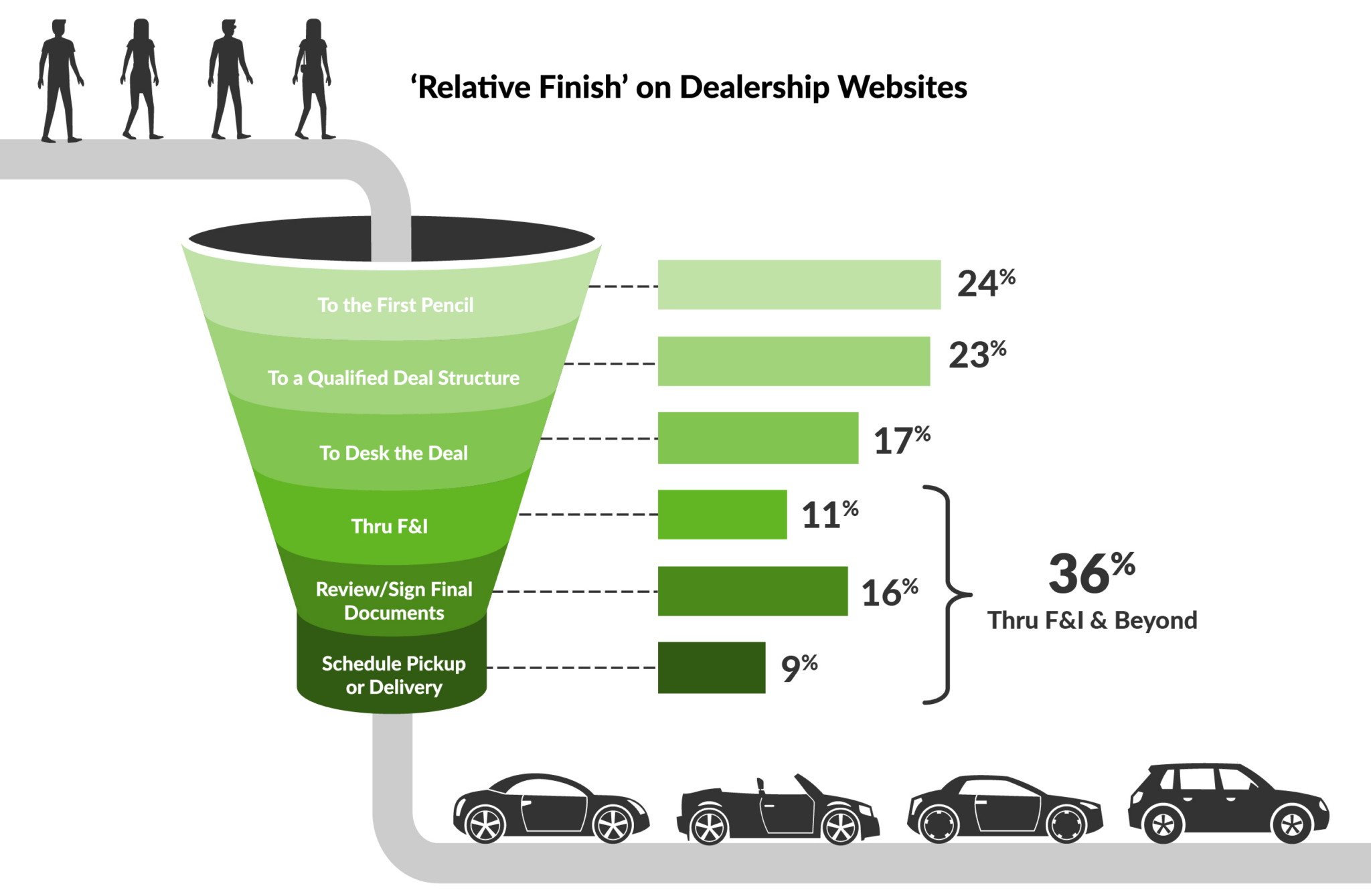

Only one-third of respondents report that their relative finish runs through F&I. 17% stop at a fundable, transactable deal structure; 23% finish at a ‘qualified’ deal structure; and 24% finish their digital path-to-purchase experience at the very first pencil. Only 9% continue the digital journey through vehicle pick-up/delivery.

Conclusion

If the longer-term end goal for the retail automotive industry is true eCommerce, the industry will need to find technologies and re-engineer business models in ways that make it easier for consumers to complete 100% of the transaction without having to visit a dealership.