The Pandemic Drove a Great Leap Forward in Digital Retailing Adoption, Part 2: What Happened When “Everything” Changed?

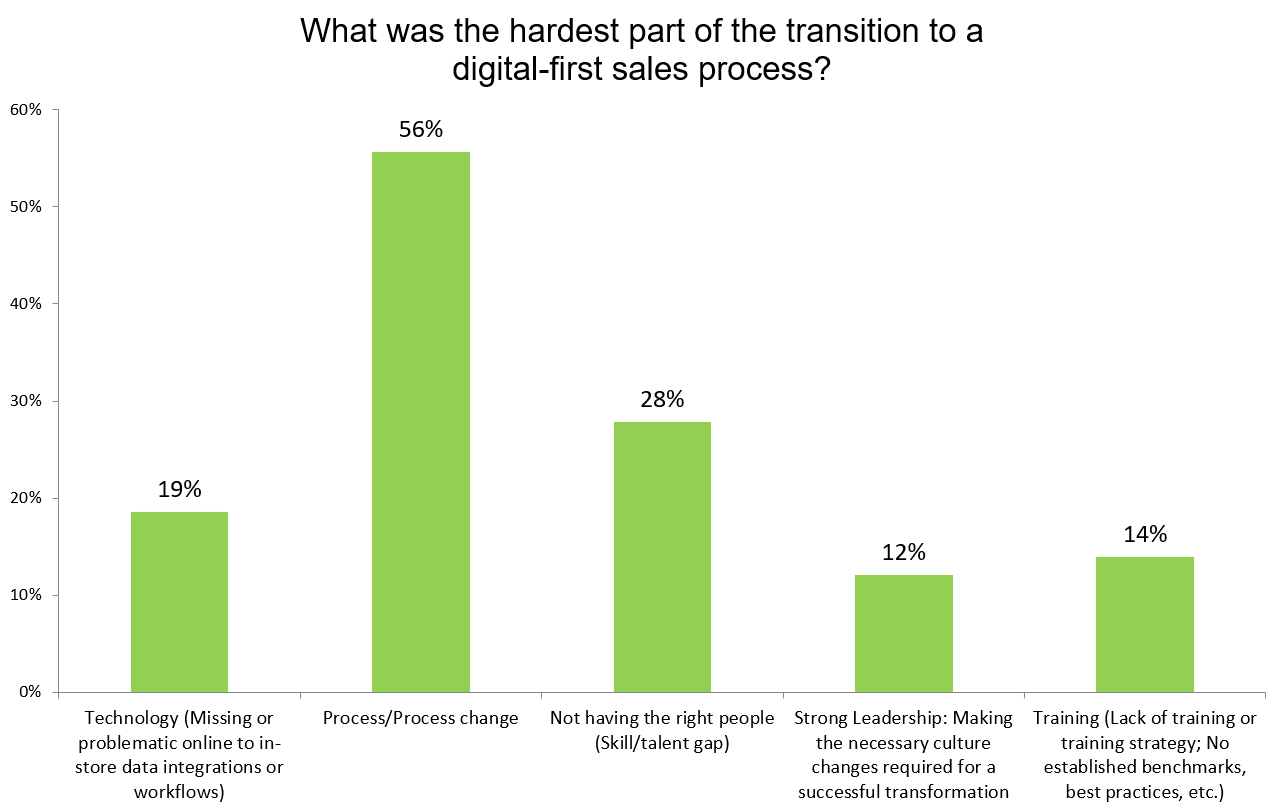

For starters, not everything did change – though as time passes the stories of the great pandemic will surely grow more dramatic. The reality is, frankly, dramatic enough: there was a fair amount of disruption to the automotive space, enough to shut factories down for months and close many dealerships. But, dealers are a resilient and resourceful group that knows how to survive. So they didn’t hesitate to pivot and find new ways to sell and service cars. And for most, that pivot included digital retailing solutions. The logic was unmistakable: by making their websites more transactional, and relying on DR to reduce in-store time to meet, greet, and deliver, many dealerships were able to stay open in a “low-touch” manner of business: eLEND’s recent survey of auto dealerships revealed that for 80%, the pandemic accelerated adoption of digital path-to-purchase experiences at their dealerships.

Let’s Make a Deal…on the Website or the Store.

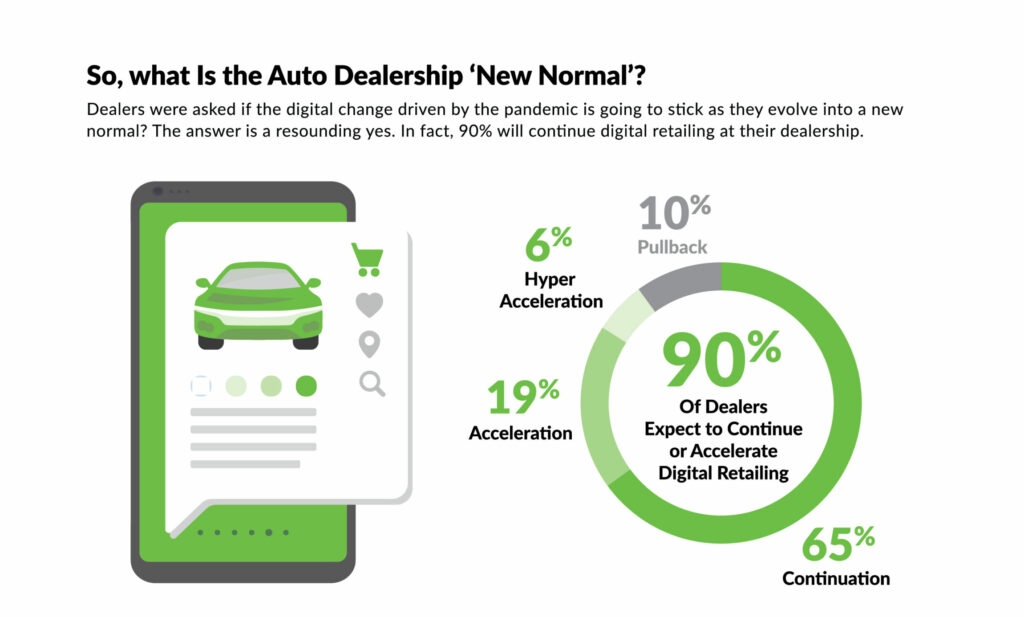

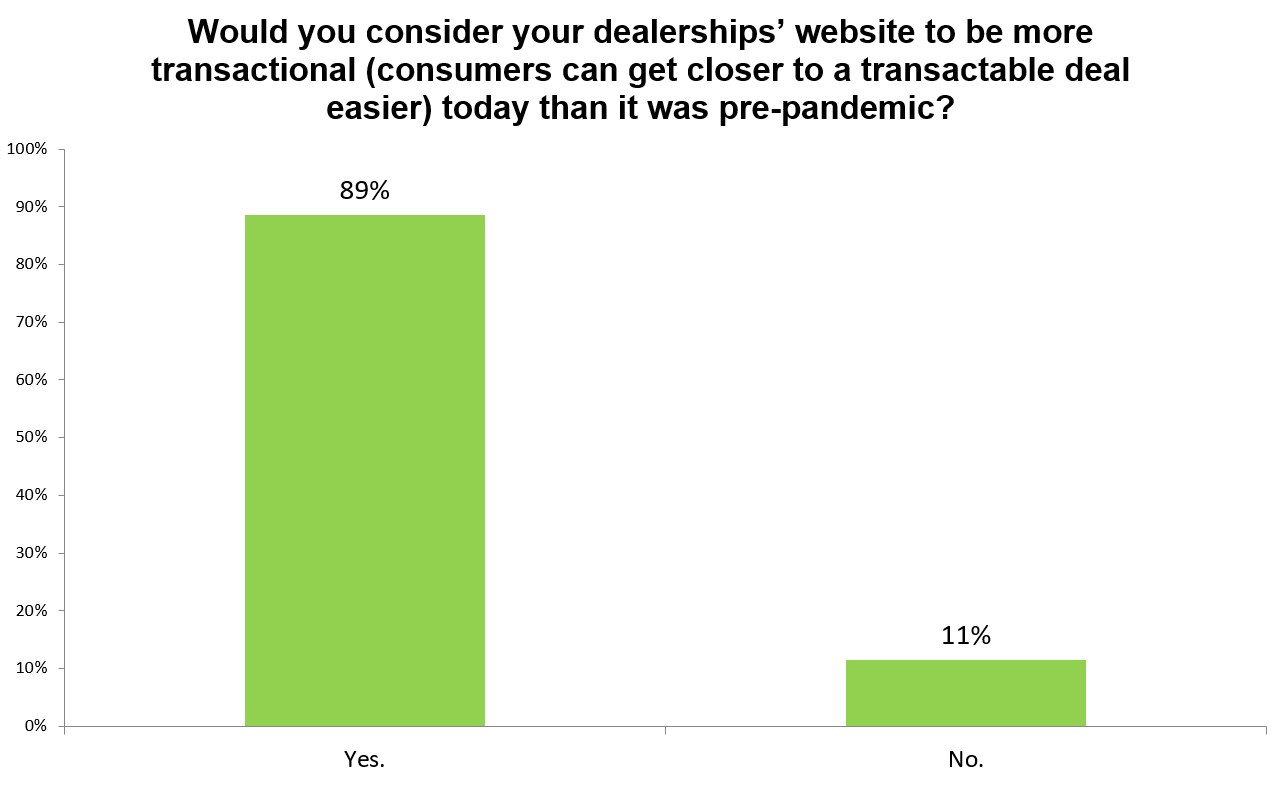

One major result of the pivot into digital retailing is that nearly 90% of dealers now say their websites are more transactional (consumers can get closer to a transactable deal easier) today than during pre-pandemic days. This survey finding suggests a silver lining: COVID-19 has impelled the industry’s rapid adoption of digital buying experiences, especially those that address consumers’ preferences for a low-touch buying experience. Many experts agree that the same level of adoption – without a pandemic – could have taken another 2-5 years.

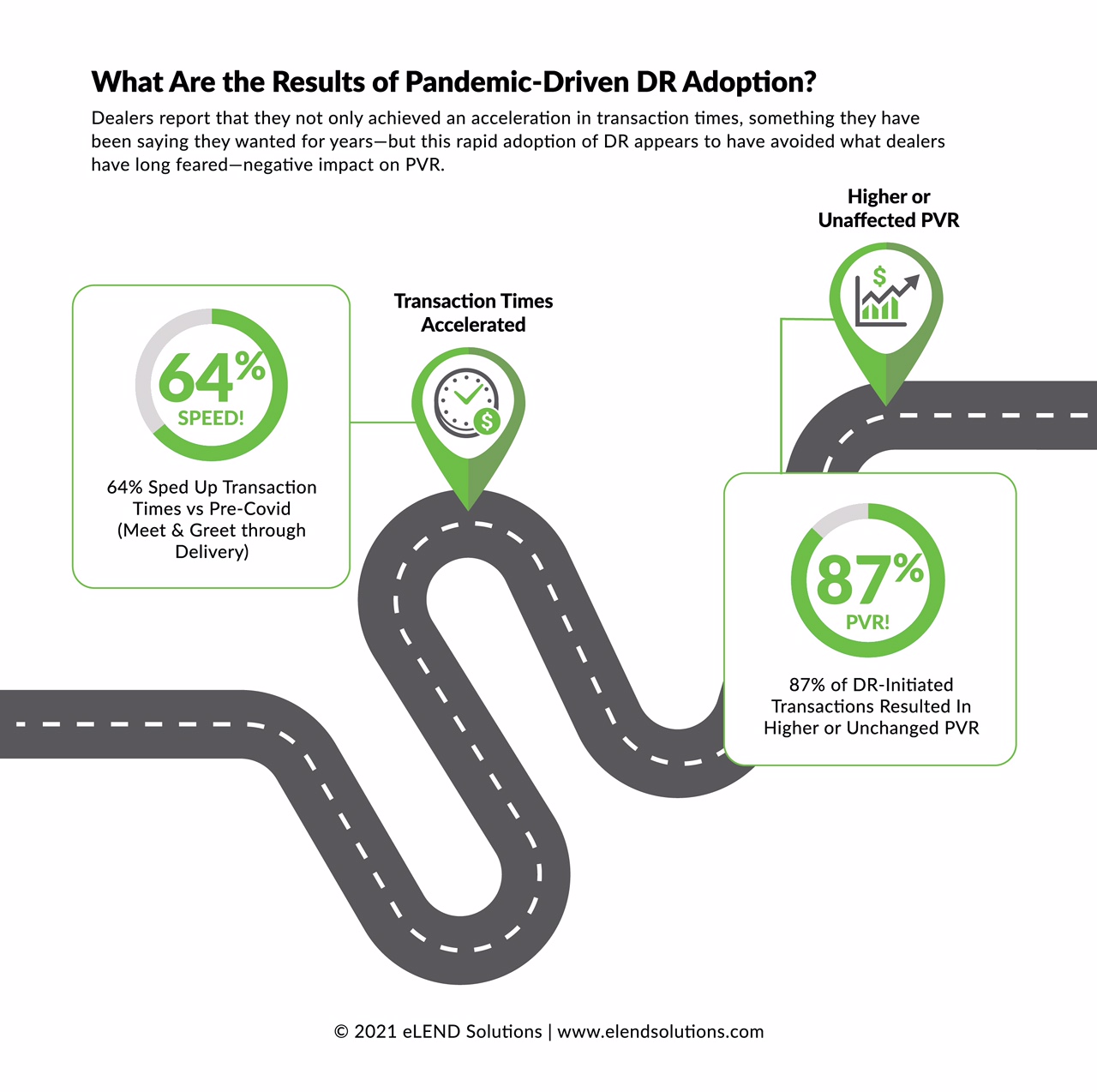

So…why? Do dealers just like DR better? Not quite. While they were keeping the doors open during the pandemic, 87% of dealers surveyed noticed that Profit-per-Vehicle, or PVR, was higher – or stable – for DR-initiated transactions. Additionally, 31% said that front and back PVR was higher when compared to pre-COVID-19 averages. The finding seems to challenge dealer notions that DR will have an adverse impact on PVR.

Faster is Better, But CSI is Underwhelming

About The Author

Pete brings 40+ years of experience in automotive finance and technology as Founder and CEO of eLEND Solutions™, an automotive FinTech company providing a middleware solution designed to power transactional digital retailing buying experiences. The platform specializes in hybrid credit report, identity verification, and ‘pre-desking’ solutions, accelerating end-to-end purchase experiences - helping dealers sell more cars! Faster!

Share this:

Recent Posts